What Does Medicare Advantage Agent Do?

What Does Medicare Advantage Agent Do?

Blog Article

The Only Guide for Medicare Advantage Agent

Table of ContentsThe 20-Second Trick For Medicare Advantage AgentMedicare Advantage Agent - The FactsHow Medicare Advantage Agent can Save You Time, Stress, and Money.The Greatest Guide To Medicare Advantage Agent

Health insurance coverage regularly places as one of one of the most essential advantages among staff members and task seekers alike. Using a team health insurance plan can aid you maintain a competitive benefit over various other employers especially in a limited job market. When employees are stressed about exactly how they're mosting likely to handle a medical issue or spend for it - they can come to be stressed and distracted at the workplace.

It additionally supplies them assurance knowing they can pay for treatment if and when they require it. Medicare Advantage Agent. The choice to supply employee health benefits commonly boils down to an issue of price. Several local business owners neglect that the premium the amount paid to the insurance coverage business monthly for protection is commonly shared by the company and staff members

What Does Medicare Advantage Agent Mean?

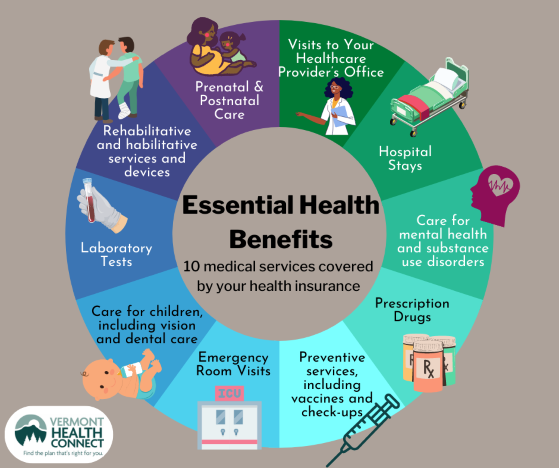

These alternatives can consist of medical, oral, vision, and a lot more. To be qualified to enroll in wellness coverage via the Market, you: Under the Affordable Care Act (ACA), you have unique client security when you are insured through the Health Insurance Market: Insurance companies can not reject insurance coverage based on sex or a pre-existing problem.

No one prepares to get really ill or hurt. If you acquire health and wellness insurance policy, it can easily cost you less money than going to the healthcare facility without it.

This way, you can get healthy and remain healthy. But health insurance policy still sets you back money and selecting the right plan for you can be difficult. What if you already have insurance policy? The details listed below can assist you understand the policy you currently have and help you when you are going shopping for brand-new insurance coverage.

Learn concerning the type of advantages to expect when you have medical insurance. Find out more regarding the price of wellness insurance policy consisting of points like co-pays, co-insurance, deductibles, and premiums. The Client Security and Affordable Care Act was checked in 2010 by President Obama. Check out this web page to find out more concerning what these adjustments suggest for you.

How Medicare Advantage Agent can Save You Time, Stress, and Money.

It will certainly summarize the essential features of the you could try these out strategy or insurance coverage, such as the covered advantages, cost-sharing arrangements, and protection limitations and exemptions. People will get the summary when purchasing coverage, enlisting in insurance coverage, at each brand-new plan year, and within seven company days of requesting a duplicate from their medical insurance company or group health plan.

Many thanks to the Affordable Treatment Act, consumers will certainly additionally have a new resource to assist them understand a few of one of the most common however complicated jargon used in health and wellness insurance coverage (Medicare Advantage Agent). Insurance provider and group health insurance will certainly be called for to provide upon request a consistent glossary of terms typically used in see here medical insurance coverage such as "insurance deductible" and "co-payment"

Medical insurance in the united state can be complicated. Numerous individuals don't have access to good protection they can afford, and countless individuals don't have any wellness insurance whatsoever. There are lots of broad view changes that the federal government needs to make so that medical insurance functions better.

Some Known Incorrect Statements About Medicare Advantage Agent

:max_bytes(150000):strip_icc()/types-of-employee-benefits-and-perks-2060433-Final-edit-60cedb43c4014fdeb51aa3cd3c25f027.jpg)

"Usually insurer additionally make modifications to benefits in terms that are usually applicable upon revival of the plan, therefore you wish to see to it that you're evaluating those and you comprehend what those changes are and just how they might impact you," Carter says. It's additionally worth checking your advantages if your health and wellness has actually changed just recently.

"If consumers can simply make the evaluation of their medical insurance policy a conventional technique, it's something that comes to be less complicated and much easier to do with time," states Carter. Exactly how much you use your medical insurance depends on what's happening with your wellness. A yearly physical with your health care physician can keep you up-to-date with what's going on in your body, and give you an idea of what kind of health treatment you might need in the coming year.

Report this page